Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

Anna Elliott, Sustainability Analyst, explains our role in collaborative, industry-wide engagement to restore fairness in the UK investment trust sector.

Investment trusts have been part of Britain’s financial fabric since 1868, financing infrastructure in the UK and beyond, long before today’s regulatory landscape existed. Yet in recent years, this sector has faced significant headwinds from higher-for-longer interest rates to regulatory challenges, most notably around cost disclosure.

In 2022, the Financial Conduct Authority (FCA) issued UK-specific guidance on the application of EU disclosure regimes.1 This required trusts to report ongoing fees in Key Information Documents (KIDs), under a framework designed for open-ended funds

Unlike open-ended funds, as listed companies, investment trust share prices should already reflect management and operating expenses. Adding these costs again in a KID lead, effectively, to double-counting, making them appear more expensive and less attractive.

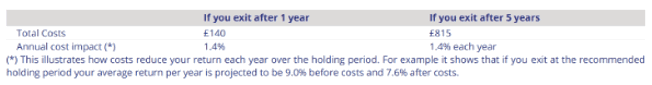

For example, Octopus Renewables Infrastructure Trust (ORIT) and Boralex, two of our renewable energy holdings, both incur operating costs which should be reflected in their share price. However, unlike Boralex, ORIT, as a UK Investment Trust, had to present these costs separately in a KID, as shown in Figure 1, creating an unfair comparison.

Figure 1: Excerpt from ORIT’s KID, dated 03-07-20252.

This is misleading to retail investors. It also affects intermediaries such as Independent Financial Advisers (IFAs) and wealth managers, who then need to incorporate these costs in their own disclosures, making their portfolios look more expensive, leading to reduced allocations.

According to Baroness Bowles in 2024, the FCA’s interpretation contributed to:

As long-term investors in UK infrastructure and shareholders in numerous investment trusts, Foresight Capital Management (FCM) have both led and supported efforts to correct this imbalance through coordinated industry engagement and company-level engagement.

In response to the FCA guidance and the subsequent position issued by Association of Investment Companies (AIC), we reached out to over 20 portfolio investment trusts who were members of the AIC, representing 48% of Foresight UK Infrastructure Income Fund (FIIF) and 17% of our Global Infrastructure Fund (GRIF).4 We encouraged them to join us in advocating for urgent reform by:

We also wrote to the Treasury to support excluding investment companies from the forthcoming Consumer Composite Investments (CCI) regime, the FCA’s post-Brexit replacement for the EU regulation, whose disclosure requirements had given rise to these issues, and co-signed a joint submission to the HM Treasury Consultation led by the London Stock Exchange (LSE).

The LSE’s letter to the Treasury garnered ‘more than 300 signatories, including 119 investment companies, 33 investors, 25 brokers and 13 research firms, along with numerous MPs and other interested parties’.5 In September 2024, following strong industry lobbying, including efforts by the AIC, the FCA announced a temporary exemption for investment companies from existing cost disclosure rules, a significant win for collective advocacy.

Following the exemption, we engaged directly with the Chairs of our portfolio trusts, encouraging them to update their disclosures (e.g. Figure 1) and set costs to zero.

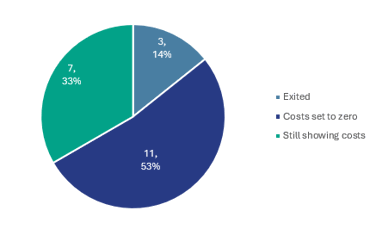

Responses varied, while some trusts acted immediately, others took a more cautious approach. By the end of FY25, around 60% of engaged companies had updated their KIDs (Figure 2). The inconsistent response showed that interim measures alone were insufficient to deliver a market-wide standard.

Figure 2: Interim state of cost disclosure following Phase 2 engagement (as of March 2025)6.

Following Brexit, the FCA is replacing EU regulation with the new CCI regime and in late 2024, released the draft policy and consultation7,8. Disappointingly, the draft maintained the treatment of investment trusts as analogous to open-ended funds.

In response, we worked with key industry bodies such as the AIC to, once again, deliver a coordinated signal. Our consultation submission centred on three key points:

Following what the FCA described as a 'vibrant' consultation process, the regulator confirmed it is exploring 'a solution that reflects the unique properties of investment trusts'.9

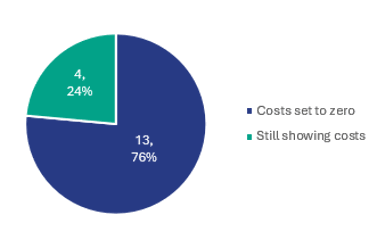

Thanks to industry-wide engagement, meaningful progress has already been made. For example:

Figure 3: Current state of cost disclosures across FCM's investment trust holdings (as of November 2025).

The FCA’s final CCI policy, expected before the end of 2025, will shape how UK Investment Trusts continue to report costs. If it fails to resolve the double-counting issue in the current format, we will continue to push for regulation that ensures a fair, competitive investment landscape. We believe addressing this is critical for the long-term success of UK Investment Trusts and their contribution to the UK economy, most notably through the provision of clean energy and social infrastructure, with ‘over £17bn of assets invested in UK infrastructure including roads, trains, wind and solar farms’.10

For more information about our work engaging with investment trusts, including other sector-specific issues, such as management fee calculations, please refer to the FCM FY2025 Stewardship Report.11

Anna Elliott

Sustainability Analyst

Foresight Capital Management

For further information, please get in touch with your regular Foresight contact or the client team on the details below:

1 Markets in Financial Instruments Directive (MiFID) and Packaged Retail Investment and Insurance-based Products (PRIIPs).

3 House of Lords statement, see: https://www.parliament.uk/business/lords/media-centre/house-of-lords-media-notices/2024/april-2024/investment-trust-cost-disclosure-requirements-urgent-steps-needed-to-resolve-problems-caused-by-fcas-rule-misinterpretation/

4 Weighted average, excluding cash, as of February 2024.

6 Across GRIF and FIIF, as of the end of FY25.

7 Replacing the EU’s PRIIPs/UCITS disclosure framework.

8 CP24/30, see: https://www.fca.org.uk/publications/consultation-papers/cp24-30-new-product-information-framework-consumer-composite-investments

9 See: https://www.investmentweek.co.uk/news/4520189/fca-allowances-investment-trusts-cci-framework

11 See: https://www.foresight.group/media/s54fxe0o/foresight-capital-management-stewardship-report-2025.pdf

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.