7 minutes

16/09/2024

Low Carbon Hydrogen: The Time is Now

The latest article from Foresight's Hydrogen Horizons initiative explores how the convergence of stable policies and rising market confidence is fueling significant growth in the hydrogen sector. Through in-depth analysis, we examine the key drivers behind this growth and highlight the potential benefits for investors looking to capitalise on the sector's promising trajectory.

Introduction

Low-carbon hydrogen is widely recognised as a crucial component in achieving global net-zero emissions targets, particularly for decarbonising industries where electrification alone is not a viable solution.

After years of early market development whilst the technical and regulatory foundations are established, the sector is finally taking off. Europe is leading the charge through the implementation of mandates that are pushing industry players to secure hydrogen to avoid penalties. The US, through the Inflation Reduction Act, is incentivising hydrogen production through tax credits. Other jurisdictions like Japan have also legislated import subsidies.

Mature policy frameworks are providing the push and confidence the industry needs to sign binding offtake agreements with suppliers. As a result, major demand centers like Europe and Japan are announcing an increasing number of agreements between hydrogen producers and offtakers.

The maturation of policy and the entry of offtakers into the market have led to a rapid acceleration in project development and investment opportunities. With a pipeline of exclusive, actionable projects in the hydrogen sector that exhibit infrastructure-like characteristics, Foresight sees robust investment prospects. While settled policies and the growing presence of offtakers contribute to market sustainability, there is still a shortage of financing. This gap creates a unique opportunity for investors to seek higher returns.

Identified pillar of global decarbonisation

The market opportunity for hydrogen infrastructure is set within the context of wider decarbonisation that is underway globally. The 2015 Paris Agreement aims to strengthen the global response to climate change by limiting the rise in global average temperature this century to well below 2 degrees Celsius above pre-industrial levels, while also striving to limit the increase to 1.5 degrees Celsius. In response to this, countries around the world have set national emission reduction objectives.

As of November 2023, around 145 countries had announced or were considering net zero targets, covering almost 90% of global emissions. Some large industries however, cannot rely solely on electrification and will strongly benefit from a low carbon molecule to remove or reduce carbon emissions from their operations. Hydrogen, when produced with low carbon intensity, is a highly promising clean energy vector. For example, high-heat industrial processes such as glass manufacturing, iron ore reduction in steelmaking, low-carbon fuel production for maritime shipping and aviation, as well as large-scale renewable power storage in congested grid networks, will all benefit from access to low-carbon hydrogen and are expected to become major consumers of low-carbon hydrogen projects

Policy is boosting the maturing of the hydrogen market

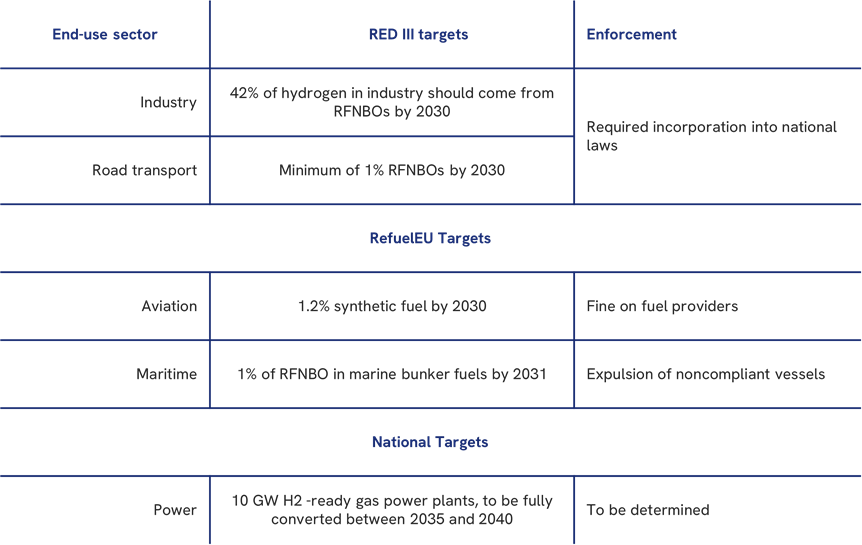

The global recognition of low-carbon hydrogen's importance has prompted governments to implement regulations that facilitate the industry's growth. Europe is at the forefront of this movement, setting clear targets, providing incentives, and establishing RFNBO (1) mandates alongside legislated goals. These policies are driving the industry forward by developing incentives and funding mechanisms that stimulate both supply and demand.

This, in turn, gives project developers the confidence to invest in hydrogen, as clarity on demand, coupled with stable policy frameworks, creates a supportive environment for the industry's expansion. The EU stands as the most advanced region in the hydrogen sector, thanks to robust support mechanisms and binding hydrogen targets that drive demand for low-carbon hydrogen. Specifically, the RED III and RefuelEU initiatives have introduced binding targets for key RFNBO-consuming industries, thereby increasing their willingness to pay.

The table below shows hydrogen's differing end-use sectors, the European Renewable Energy Directive (RED III) targets alongside Japan's national targets and current enforcements:

Increasing number of offtakers are signing binding agreements

We are now witnessing a steady stream of announcements regarding low-carbon hydrogen offtake agreements and large tenders in the suppliers' market. This surge in activity is largely driven by existing mandates, as well as the growing confidence among industrial users in the hydrogen market's expansion and the medium-term availability of the molecule.

Below is a selection of offtake agreements and tenders announced this year:

- ThyssenKrupp Tender for 151,000 tonnes of green hydrogen: 14th February 2024

- TotalEnergies signs major offtake deal for green hydrogen from Air Products for use in its European refineries: 7th June 2024

- Japan’s largest power company to invest more than $6bn to secure seven million tonnes of hydrogen supply by 2035: 17th May 2024

- H2 Green Steel secures another seven-year offtake, as lenders hint at what makes these short-term deals bankable: 22nd May 2024

- European Energy and Metafuels sign Danish e-methanol offtake: 22nd May 2024

Other new markets are expected to further boost the ramp-up of low carbon hydrogen. Technological and chemical innovations are opening new doors that will facilitate the commoditisation of hydrogen in the next phase of the market. The Methanol-to-Jet fuel production pathway and the ammonia powered vessels are good examples of substantial markets with investment opportunities.

Projects announced and the funding gap

An estimated $194 trillion will need to be invested in energy by 2050 to achieve net-zero targets, with annual investment requirements increasing from €5.5 trillion per year throughout the remainder of the 2020s to €7.4 trillion per year by the 2040s (2).

Of these investment targets, hydrogen infrastructure represents a significant portion, especially where electrification is not a viable solution. Research estimates a minimum of €4.6 trillion investments is required into the clean hydrogen supply chain to reach net zero targets (3).

The IEA has identified an immediate funding gap of €268 billion (4). There have been €295 billion direct investments announced in low carbon hydrogen projects globally through 2030, but only €27 billion has passed FID or is in more advanced stages.

IEA Global Hydrogen Review: 2023 Funding Gap (4)

Conclusion

Despite experiencing rapid growth, a considerable funding gap remains, presenting both challenges and opportunities across the hydrogen market. This gap, while daunting, offers a unique investment opportunity for those looking to capitalise on the sector's growth potential. As the hydrogen market continues to mature, it will play an increasingly vital role in global decarbonisation efforts, supported by a robust pipeline of projects and the growing confidence of market stakeholders.

To find out more about Foresight's experience or speak to a member of the team click here.

Author: Senior Investment Manager, Adrien d'Ormesson

Footnotes:

1 | Renewable liquid and gaseous fuels of non-biological origin, in this case includes hydrogen and derivatives

2 | NEF – New Energy Outlook (2022, p.6), Net Zero Scenario. These figures include both fossil and clean-energy supply projects, as well as clean demand-side areas such as electric vehicles and heat pumps.

3 | Carbonomics, The Clean Hydrogen Revolution (2022), Goldman Sachs Global Investment Research

4 | Global Hydrogen Review, 2023, IEA

Take a look at our previous Hydrogen Horizons event where we brought industry leaders together to discuss the scaling up of the hydrogen market:

Important information – This article is for information purposes only and should not be considered investment advice. We recommend investors seek professional advice before deciding to invest. Investors must read the relevant Prospectus, Key Information Document, Investor Guides and Offering Documents before making an investment decision. Attention should be paid to the risk factors set out in these documents and risk warnings on our website. The value of an investment, and any income from it, can fall as well as rise.